Preventing DePIN Governance Capture

My Product experience using Vote-Escrow tokens

In my previous post on DePIN governance models, I pointed-out that protocols face a critical risk from plutocracy as they transition from foundation control to community governance. Token-weighted voting, without structural safeguards, allows well-capitalized actors to accumulate governance power instantly, potentially capturing protocol direction before the community can organize.

The question that emerges is how to decentralize governance without handing control to whoever can buy the most tokens on day one.

Vote-escrow (VE) tokens offer a solution by tying voting power to both stake size and commitment duration, VE mechanisms ensure that governance influence must be earned over time, not purchased overnight.

The Plutocracy Problem

Standard token governance operates on a simple principle: one token, one vote. This creates an immediate vulnerability in that a well-funded actor, whether a hostile acquirer, a competing protocol, or an opportunistic whale, can purchase a controlling stake and immediately direct protocol decisions.

The attack surface is straightforward:

Accumulate tokens through open market purchases or OTC deals

Submit governance proposals that benefit the attacker

Vote with overwhelming weight before the community can respond

Extract value or redirect protocol resources

For DePIN protocols managing physical infrastructure, the stakes are high. Governance decisions affect node operator economics, hardware requirements, geographic distribution, and service quality. A captured protocol doesn’t just lose treasury funds, it can degrade the physical network that users depend on.

How Vote-Escrow Tokens Work

Vote-escrow mechanisms decouple token ownership from immediate voting power. Instead of granting instant governance rights, VE systems require participants to lock tokens for a specified duration. Voting power then accrues gradually over the lock period.

The core mechanics are:

Stake and Lock: Participants stake tokens and select a commitment period (e.g., 1 to 48 months).

Receive VE Tokens: The protocol issues non-transferable vote-escrow tokens (e.g., veToken) in a 1:1 ratio to staked tokens.

Gradual Accrual: Voting power accrues linearly over the staking duration. Full voting power is reached only at maturity.

Exit Penalty: Unstaking before maturity burns all accrued VE tokens immediately, forfeiting governance rights.

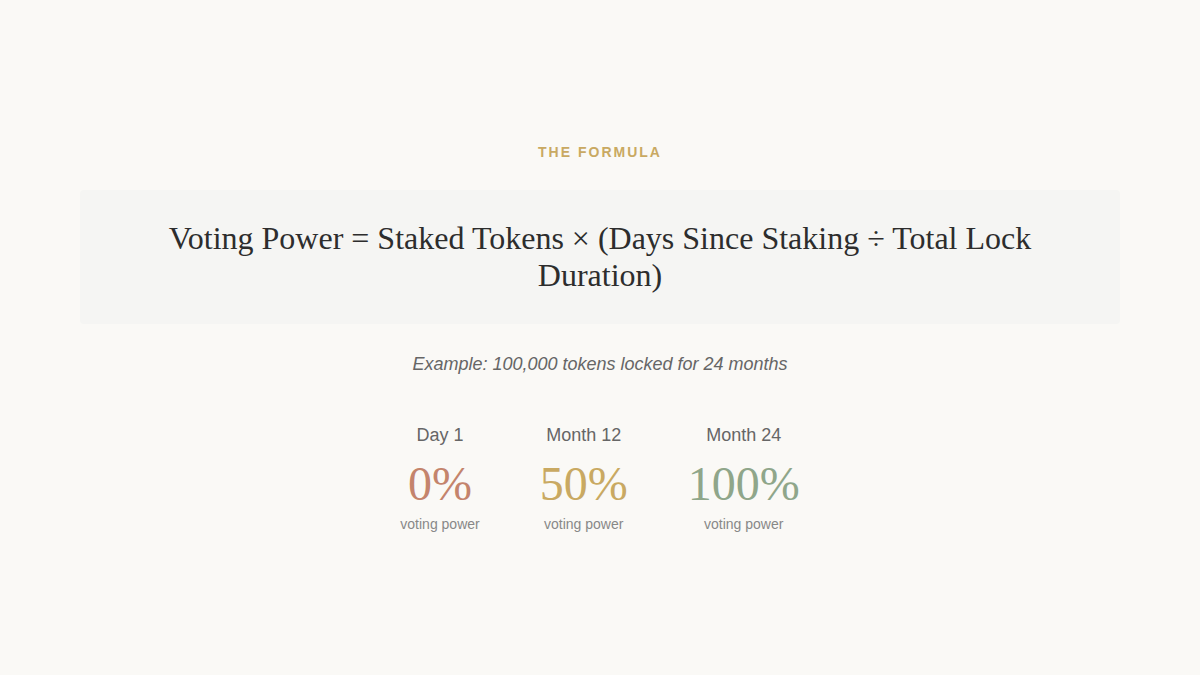

An example formula for voting power at any point in time:

Voting Power = Staked Tokens × (Days Since Staking / Total Lock Duration)

This means a participant who stakes 100,000 tokens for 24 months has zero effective voting power on day one. After 12 months, they have 50% of their maximum voting power. Only at month 24 do they achieve full governance weight.

Why Gradual Accrual Prevents Capture

The time-lock mechanism transforms governance from a capital game into a commitment game. Several dynamics emerge, as below:

Attackers Can’t Strike Instantly

Even with unlimited capital, an attacker cannot immediately amass voting power. They must wait through the accrual period, giving the existing community time to identify the accumulation, organize a response, and potentially counter-stake.

Accumulation Becomes Visible

Large stakes are observable on-chain. A governance dashboard showing VE token balances and voting weight distribution allows the community to monitor power concentration in real time. When a single entity begins accumulating significant governance weight, it becomes visible months before they can act on it.

Commitment Signals Alignment

Long lock periods impose opportunity cost. Participants who lock tokens for extended durations are betting on the protocol’s long-term success. This filters out short-term speculators and mercenary capital, the actors most likely to extract value at the community’s expense.

Exit Destroys Power

The immediate burn of VE tokens upon early exit means governance power cannot be transferred or sold. An attacker who changes strategy cannot simply sell their position to another bad actor while preserving voting rights. Exiting resets the clock entirely.

Implementation Details That Matter

The effectiveness of VE tokens depends on careful parameter design. Based on my operational experience, several implementation choices are critical:

Non-Transferability

VE tokens must be non-transferable. If vote-escrow positions could be traded, a secondary market would emerge allowing instant governance power acquisition, defeating the entire purpose. The tokens represent a commitment, not an asset.

Delegation Mechanics

For DePIN networks with node operators and delegators, governance rights should flow appropriately. Delegators who stake tokens with a node operator typically delegate their governance rights as well. This concentrates voting power with operators who have operational skin in the game, while allowing passive participants to earn yield without governance responsibility.

Locked Token Governance

Core team and investor tokens under vesting schedules present a special case. These participants may need governance rights before their tokens unlock. A reasonable approach is to allow locked tokens to be staked for governance (earning VE tokens) but not for yield. This grants governance participation while preventing double-dipping on economic benefits.

Foundation Veto During Transition

Even with VE protections, early-stage protocols face capture risk from large pre-launch investors whose tokens vest into governance power. A foundation veto council with authority to block proposals during an initial period (e.g., 36 months) provides a backstop while the community’s VE power matures. The veto should have a defined expiration, ensuring it’s a training wheel, not a permanent brake.

The Three-Phase Governance Transition

VE tokens are most effective as part of a deliberate governance transition. The hybrid model I outlined in my last post maps well to VE implementation:

Foundation Phase: Council oversees treasury and operations. VE staking begins, but foundation retains veto power. Community members start accumulating governance weight.

Co-Governance Phase: DAO proposals gain authority but require foundation ratification. VE token distribution becomes more decentralized as early stakers reach maturity. Foundation veto is used sparingly, only for existential risks.

DAO Phase: Foundation veto retires. On-chain execution becomes binding. By this point, VE token distribution reflects years of committed participation, not recent capital accumulation.

The gradual accrual curve means that by the time full decentralization arrives, governance power is distributed among participants who have demonstrated multi-year commitment to the protocol’s success.

Transparency as Defense

VE mechanisms work best when governance power distribution is fully transparent. A protocol implementing vote-escrow should provide:

Real-time VE token balances per wallet and node

Voting weight distribution across the network

Historical governance participation metrics

Projections of future voting power based on current stakes

This transparency serves dual purposes: it allows the community to identify emerging concentrations early, and it creates social accountability for large holders. A whale accumulating governance power in public faces reputational pressure that a shadow accumulator does not.

Conclusion: Time as the Ultimate Filter

Vote-escrow tokens don’t make governance capture impossible. A sufficiently patient, well-resourced attacker could still accumulate power over years. But VE mechanisms dramatically raise the cost and timeline of attack while providing the community with early warning and response time.

For DePIN protocols, where governance decisions affect physical infrastructure and real-world operations, this time buffer is essential. The operators running nodes, the developers building applications, and the users depending on services all need assurance that protocol direction won’t shift overnight at the whim of a new token holder.

The question for any protocol implementing token governance isn’t whether to use vote-escrow mechanics, it’s whether you can afford not to. In a world where capital moves faster than communities can organize, time-locked governance may be the only defense against plutocratic capture.

Governance is hard. VE tokens make it harder to subvert.